ESG & SFDR Reporting and

EET Automation

How do we help

The Sustainability Finance Disclosure Regulation (SFDR) requires asset managers to report detailed information about their Environmental Social & Governance (ESG) investments and fund strategies.

Besides the publication of SFDR documents and website disclosures, asset managers are required to disseminate the underlying data to distributors and data vendors using the European ESG Template (EET).

Data Management, Enrichment and Calculations

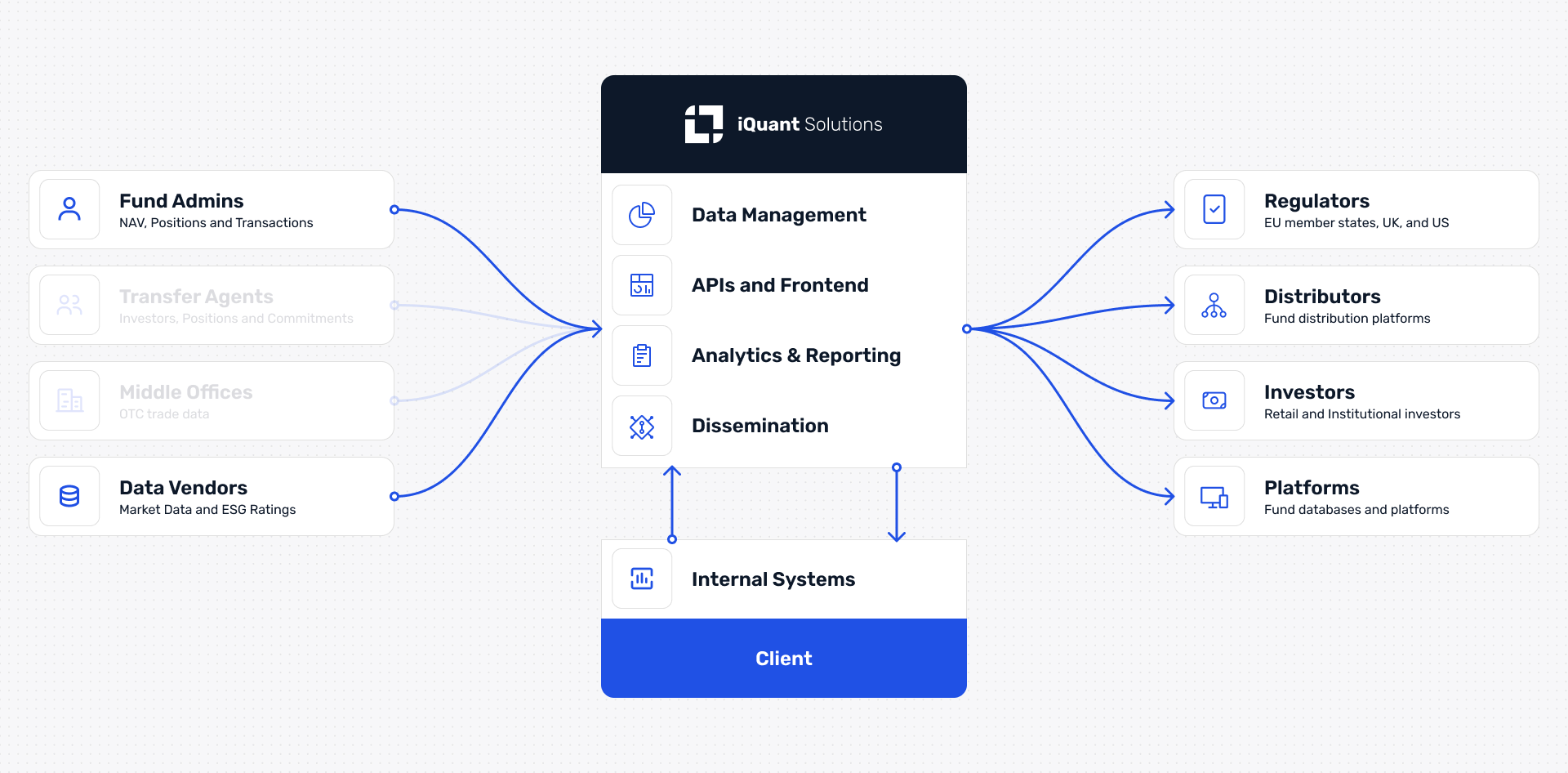

We integrate fund static data and positions, as well as external ESG data into our system, and provide calculations such as EU Taxonomy or Principle Adverse Impact (PAI) ratios.

Production of all SFDR-Reports

We produce EET templates and all other relevant SFDR disclosures on a fund level, as well as on an entity level. This includes pre-contractual, periodic documents, and website disclosures.

How we do it

SFDR is one of the largest milestones in the history of investment regulations, with a significant impact on fund product management and fund distribution. As such, asset managers are challenged with very broad requirements that take fund reporting to an unprecedented new level. SFDR does not only apply for UCITS, but also for all other fund types such as Alternative Investment Funds and Special Investment Funds.

According to the regulation, funds are now classified into three different categories:

Article 6:

Funds which do not follow or reflect an ESG-related investment strategy.

Article 8:

Funds which promote environmental or social characteristics (or a combination), provided that the companies in which the investments are made follow good governance practice.

Article 9:

Funds which have a focus on sustainable investments as their objective. This means that the funds are following an active ESG portfolio management strategy.

The SFDR reporting requirements apply to all funds independently of the relevant classifications above.

Where asset managers sell and market either Article 8 or Article 9 funds, they need to report in detail if the underlying investment strategy reflects a large number of ESG requirements, as set out by the European Union. The most important criteria are the PAIs and the EU Taxonomy.

PAIs relate to negative effects on environmental and social matters. There are 18 mandatory PAI indicators on which asset managers need to report. The EU Taxonomy is a classification system that defines which parts of the overall economy can be considered sustainable investments.

Asset managers are required to disclose all details of their fund-related ESG strategy in specific pre-contractual and periodic reports, as well as on their website. This also applies to Article 6 funds, however the reporting effort is much lower than in the case of Article 8 and 9 funds.

The SFDR regulation goes hand in hand with the latest MiFID II adaptions

as the regulator aims to major targets:

Avoid ‘Greenwashing’

ESG transparency to retail investors

EET Production (European ESG Template)

The EET is the new SFDR data exchange format for the asset management industry, and covers all SFDR data points. It has been defined by the FinDatEx working group and will be used by all asset managers to disseminate their fund-related SFDR data to distributors, including insurance companies, banks and fund platforms. The logic is in line with other FinDatEx templates such as EMT or EPT.

The EET mainly consists of the following sections:

Static data

(ISIN, share class name etc.)

ESG target market classification

ESG relevant data:

Principle Adverse Impacts and EU Taxonomy alignment

It consists of 500+ fields and is due on 1st January 2023. However, the first version, the so-called “EET light” is already due on 1st June 2022.

The “EET light” only consists of 62 fields depending on the fund type (Article 6, 8 or 9) and does yet not include any position reports or calculations.

We support asset managers with all EET-related tasks: data gathering and management, advice on the different data fields, EET report production and dissemination to distributors.

SFDR Documents and Disclosures

Asset managers are required to disclose all ESG-related information as set out in the SFDR regulation in pre-contractual and periodic documents. The templates are predefined in the relevant annexes of the Regulatory Technical Standards (RTS) and are due as of 1 January 2023.

The documents will be published as annexes to the fund prospectus. Additionally, asset managers need to disclose all information regarding PAIs and EU Taxonomy alignment on a website, as defined in the RTS.

We support asset managers with the production and dissemination of all SFDR-related documents and disclosures.

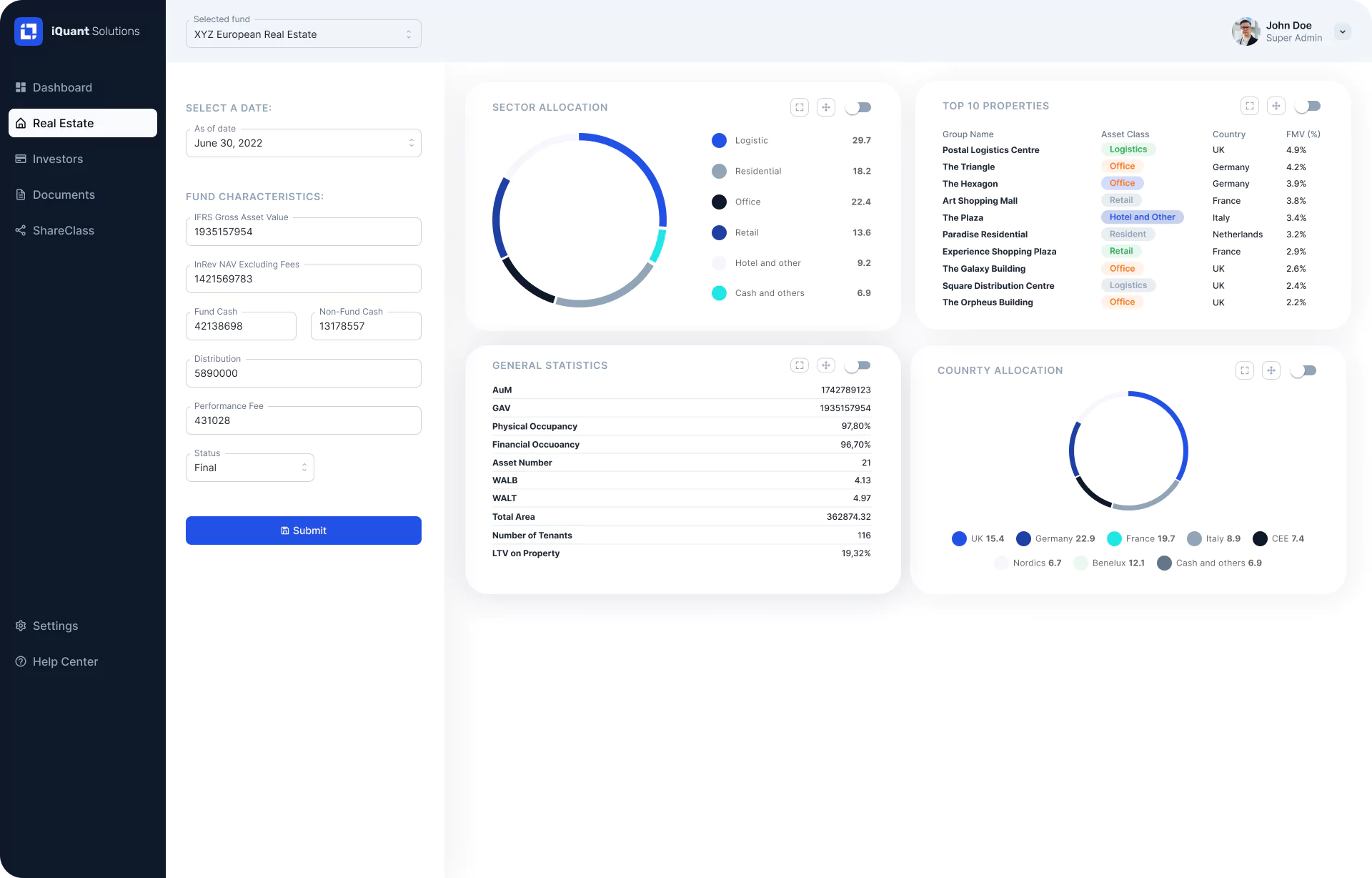

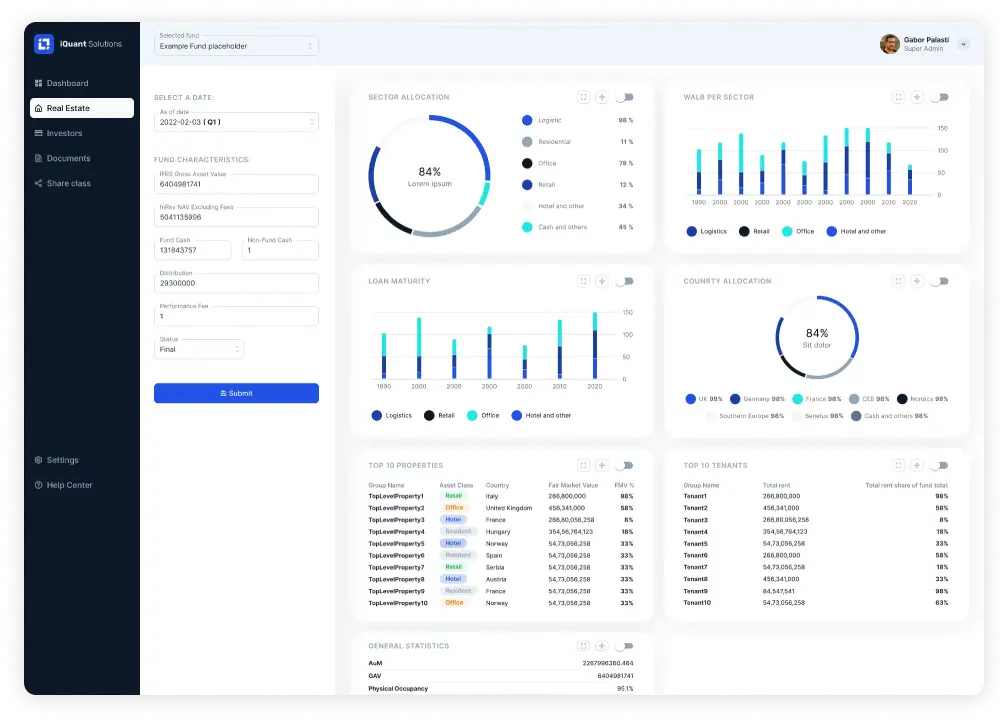

Manage, validate and deliver your fund data — all in one platform.

Access and manage fund data, regulatory templates and performance reports from anywhere, anytime. Our cloud-based platform helps financial institutions centralize reporting, automate calculations and deliver compliance-ready outputs at scale.

Learn more