MiFID II Reporting Automation

How do we help

MiFID II regulation came into effect in 2018 and set out new rules, especially for the distribution of financial products to retail investors. Distributors need to classify financial products and make sure that they’re suitable for their clients. As, in most cases, the distributors are not the manufacturers of funds, MiFID II consequently causes a significant reporting burden to asset managers.

Static Data, Target Market Classifications, and Cost & Charges

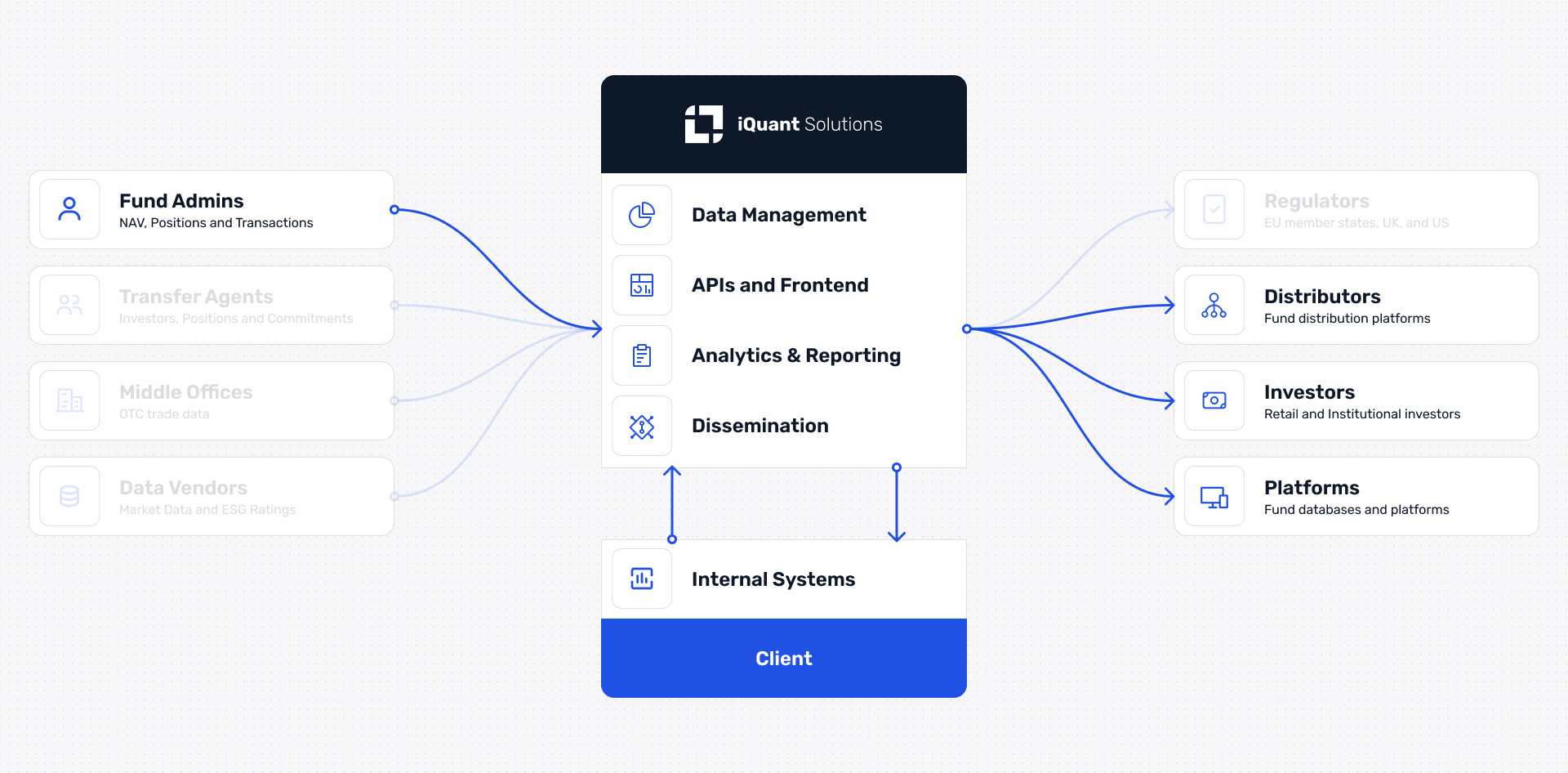

We integrate fund static data, target market classifications and cost data from various sources (including asset managers and fund administrators etc) and establish a golden source of information for all MiFID II related reports and data disclosures.

Production of EMT 4.0

Production and dissemination of the latest European MiFID Template (EMT 4.0) in accordance with the FinDatEx data standard.

Our automation service includes Cost and Charges calculations.

How we do it

Background

The original Markets in Financial Instruments Directive (MiFID) was introduced in November 2007 with the aim of regulating the distribution of financial products and strengthen the competitiveness of the European financial markets. However, the 2008 financial crisis pointed out several weaknesses of MiFID I. MiFID II came into force in 2018 and directly responded to the protection of private investors.

One of the key points of MIFID II is the so-called ‘target market’ classifications. Distributors such as banks need to classify all products which they’re selling to retail investors. This also applies to funds sold by distributors, although UCITS managers are not directly covered by this part of the regulation. As distributors are neither the managers of the funds nor the data owners, they rely on the asset managers to provide all relevant data.

Reporting Requirements

To facilitate the data exchange, the EMT was introduced by the FinDatEx working group. With the MiFID II changes came into force on 1 August 2022 are intended to reflect ESG investment preferences with regards to fund distribution, going forward the new EMT 4.0 will be aligned with the EET. EMT 4.0 no longer includes ESG-related target market criteria (especially concerning the German fund market) as was the case in EMT 3.1. Instead, all relevant ESG target market information and preferences are instead represented in the EET.

Therefore, distributors and providers are expecting both templates to be provided jointly, in order to receive full coverage of SFDR and MiFID II data. This improvement positively impacts the dissemination of fund data, as different formatting and logical requirements across several markets will no longer be a significant challenge for asset managers.

Our service includes all EMT-related components such as:

Data management

Cost calculations

Report production and dissemination to distributors, platforms and data providers

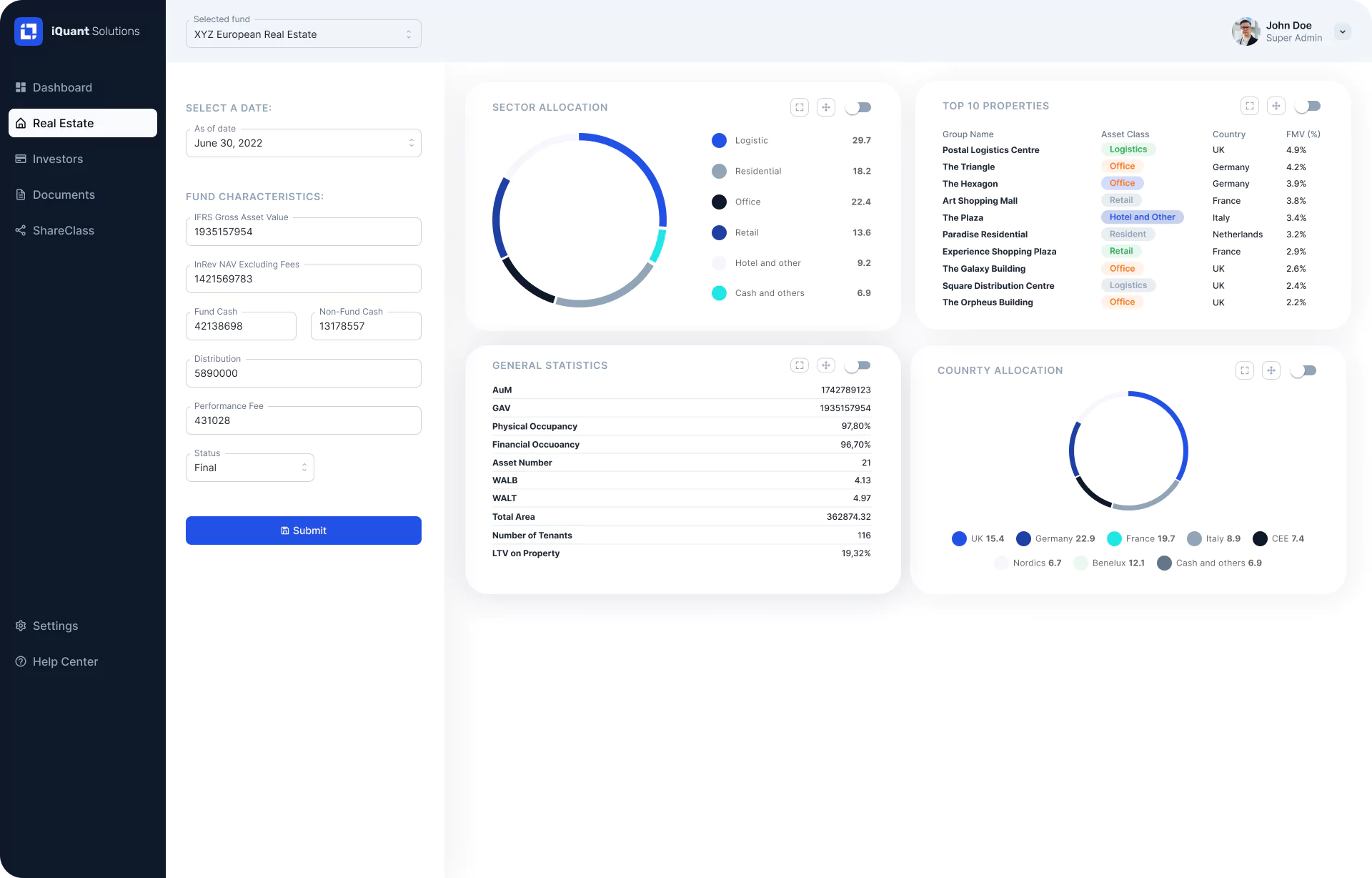

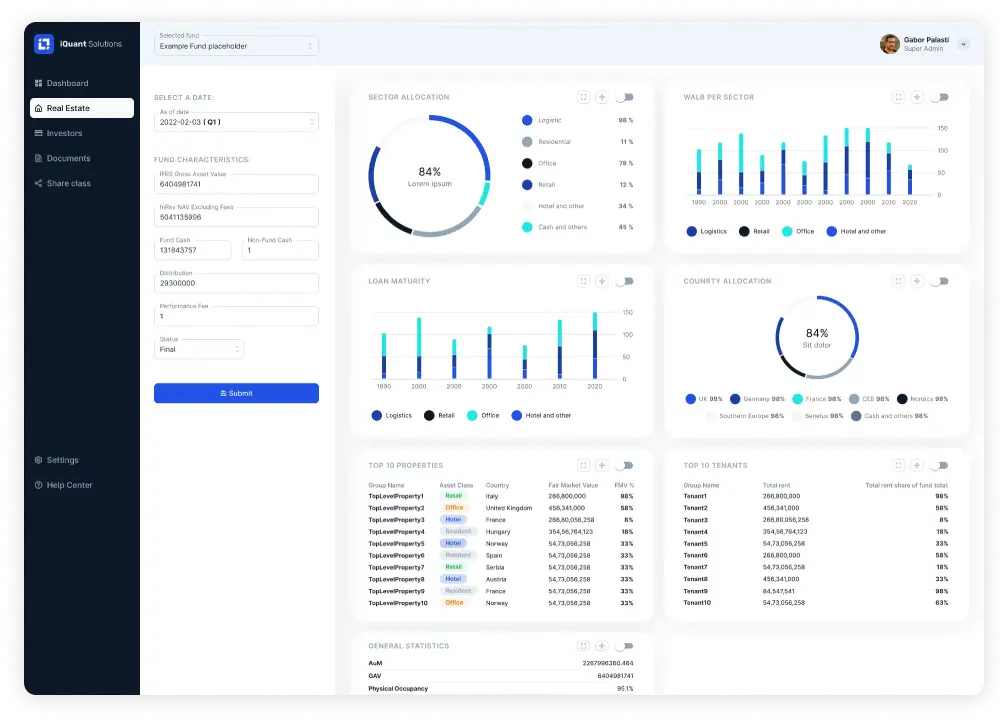

Manage, validate and deliver your fund data — all in one platform.

Access and manage fund data, regulatory templates and performance reports from anywhere, anytime. Our cloud-based platform helps financial institutions centralize reporting, automate calculations and deliver compliance-ready outputs at scale.

Learn more