Fund Data Dissemination

and Integration

How do we help

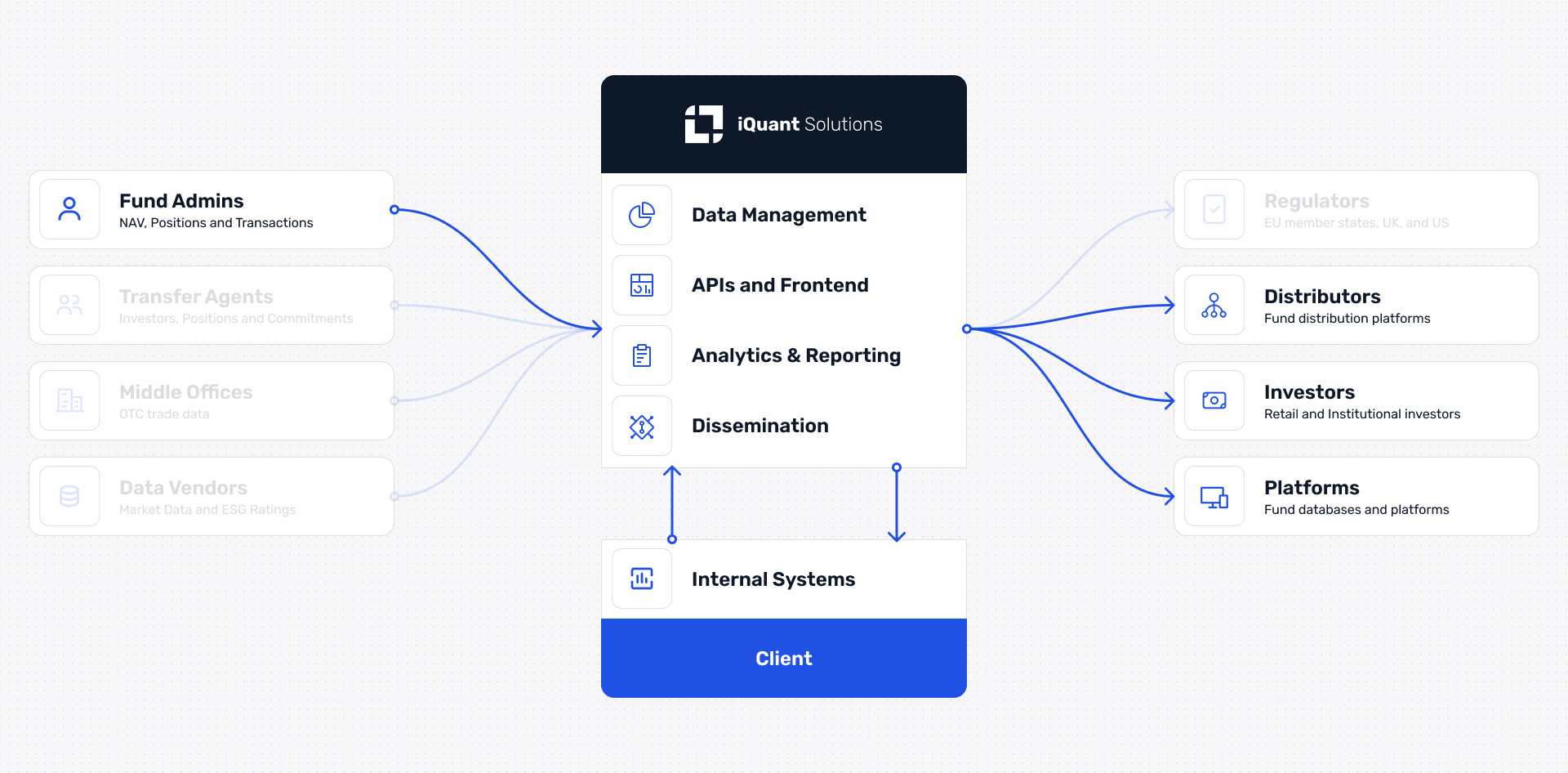

Fund managers and asset managers are facing increasing challenges with data management and dissemination.

Additionally, fund platforms and distributors require high-quality and up-to-date information about the funds to offer these to investors.

Golden Source

Raw data is acquired directly from the source and is standardized and validated according to iQuant's proprietary data model.

Dissemination

We disseminate fund static and dynamic data including NAV and positions to a wide range of different platforms and fund distributors.

How we do it

Fund managers and asset managers are facing increasing challenges with data management and dissemination. Due to the surging complexity of regulatory disclosure requirements imposed by MiFID II and PRIIPs, fund managers can no longer maintain their fund static data in spreadsheets.

To add to the complexity, there are multiple reporting standards available on the market that all have their own mapping logics, classification of regulatory data, and formatting requirements.

In addition, country-specific rules have to be considered to ensure compliance with the local regulations of various countries.

iQuant Solutions is supporting clients to meet these challenges. We are resolving data errors, eradicating the need for error-prone manual work, and reducing operational effort. iQuant Solutions delivers systematic data management that establishes the golden source of data for our fund manager clients.

Systematic Data Management:

Golden Source

Raw data is acquired directly from the source and is standardized according to iQuant's proprietary data model. While static data is generally provided by the fund manager, dynamic data such as NAV and holdings data are best obtained from the fund administrator.

Our ever-growing data model library covers a wide range of static data fields, MiFID II information, Costs & Charges, portfolio valuation, and much more.

Seamless Data Acquisition

iQuant offers two data acquisition methods: automated straight-through processing and a custom data model. Our clients are encouraged to use our API solution to get real-time access to their own data. The API is also used to update static data points as changes occur.

iQuant also offers a custom data model so that clients are not obliged to use our data model definition. In this scenario, we receive input data in client-specific raw format and our data management team uploads the new information and changes into the iQuant system.

Validation, Consistency Testing

and Data Cleansing

Each data point entered in the system goes through a range of robust tests, consistency checks, and validations. The results are available to the client and automated notifications are sent in cases of faulty or inconsistent information. To reduce the manual work to a minimum some anomalies can be automatically detected and fixed during the data ingestion process.

This data cleansing process significantly reduces the interaction and effort required during the data acquisition phase. All changes are logged and reported to our clients.

Integrated Fund Reporting Standards

The iQuant system is fully integrated with a number of fund data reporting standards such as FinDatEx, openfunds, WM Daten, FundsXML and many others.

Fund Platform Management

There are growing numbers of fund platforms that provide data to potential investors, existing clients, and distributors. These platforms all require static fund and MiFID II information.

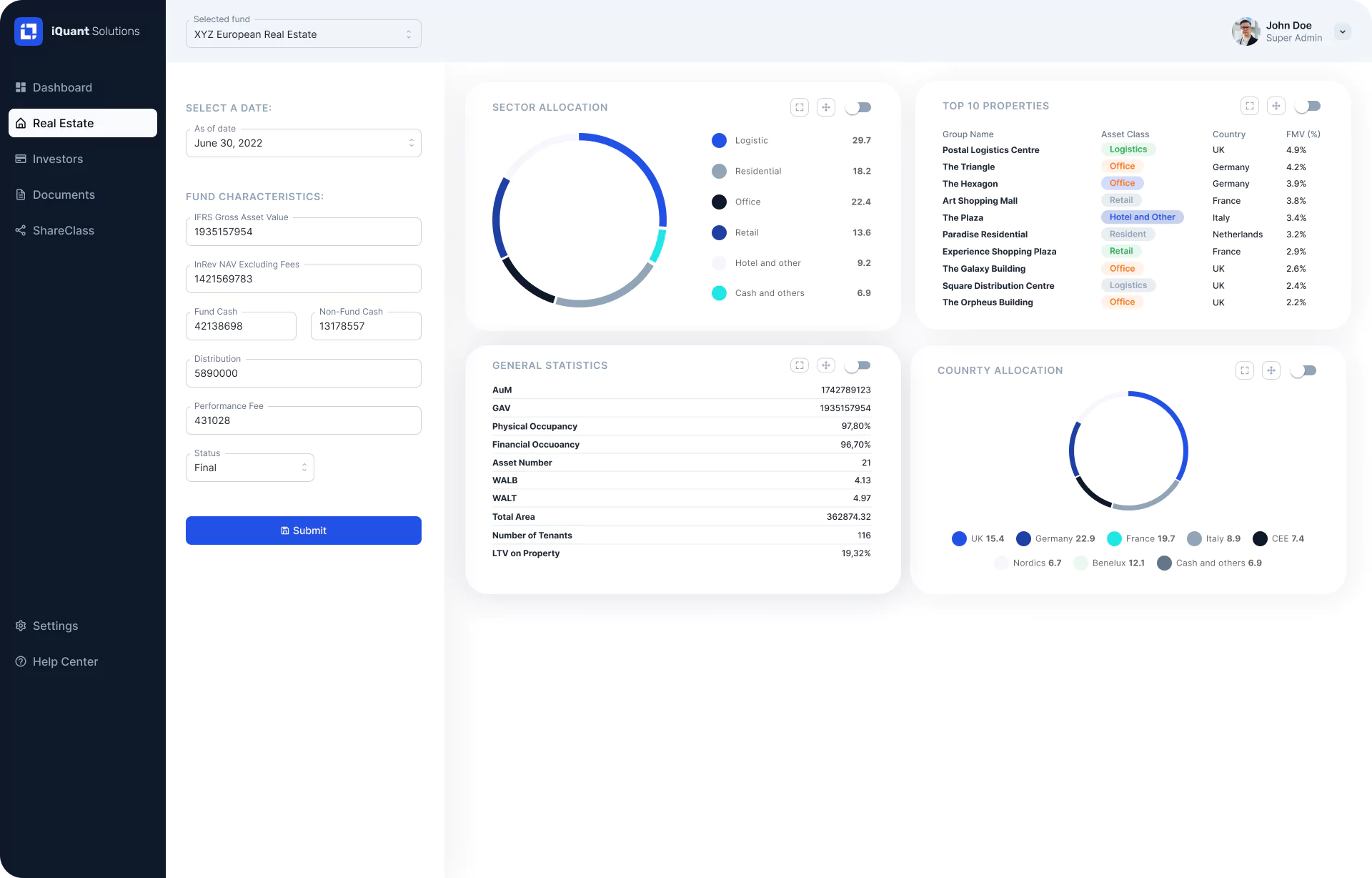

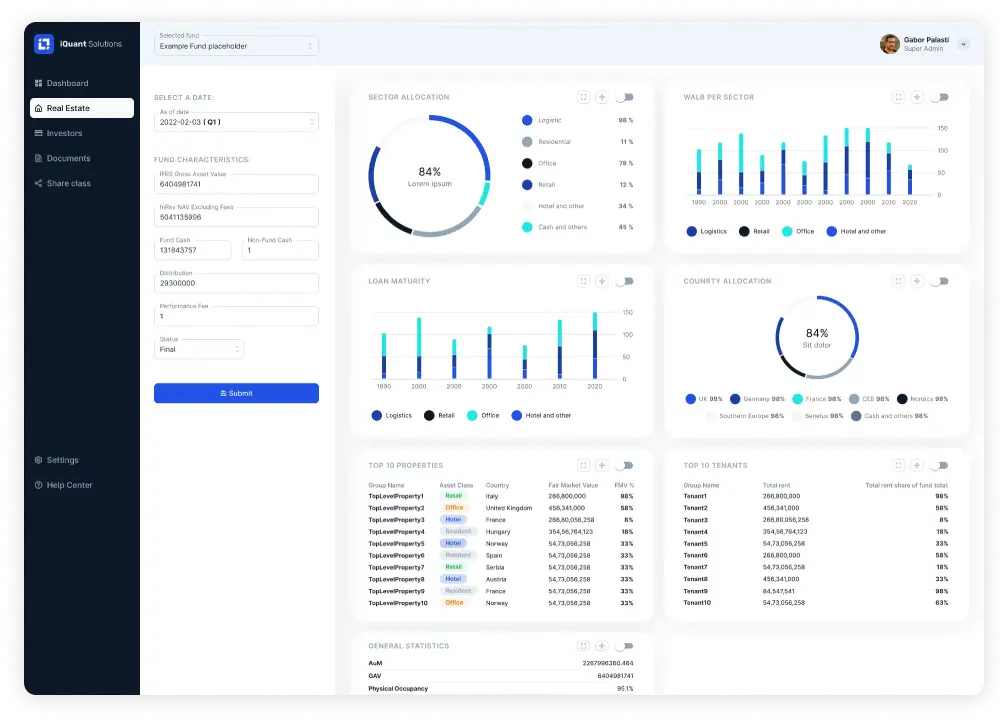

Manage, validate and deliver your fund data — all in one platform.

Access and manage fund data, regulatory templates and performance reports from anywhere, anytime. Our cloud-based platform helps financial institutions centralize reporting, automate calculations and deliver compliance-ready outputs at scale.

Learn more